The Middle East economy was in full-year recession for 2020, as per IMF data, with GDP growth falling in all four quarters.

Oil-exporting Gulf economies were subjected to a double whammy of lockdowns as well as a collapse in oil prices. The Saudi Arabian economy contracted at its steepest pace in Q2 2020 with -7% GDP growth, with recovery likely to begin only in Q2 2021.

In October 2020, IMF projected the UAE GDP to contract by -6.6% in 2020 due to COVID-19 and lower oil production. Dependent on the speed of global recovery, growth is expected to reach 2.5% by 2022, supported by government recovery plans, higher oil revenues, and a boost from the delayed Expo Dubai 2020.

Source: General Authority of Statistics. KSA

In Q3 2020, containment measures had been relaxed in most parts of the GCC, leading to the resumption of activities to some extent. This translated into a rapid quarter-over-quarter GDP expansion in Q3 2020. However, GDP growth, when measured against the same quarter of last year, remained in the negative territory in Q3 and Q4, given prolonged restrictions and their impact: especially across sectors such as travel and tourism, hotels and restaurants, entertainment, and education.

Demand is likely to improve with the lifting of lockdowns, but remain muted, on account of job losses and a dampened consumed sentiment. From Q1 2021, we expect a positive rebound in GCC GDP, with GDP returning to full recovery by Q4 2021.

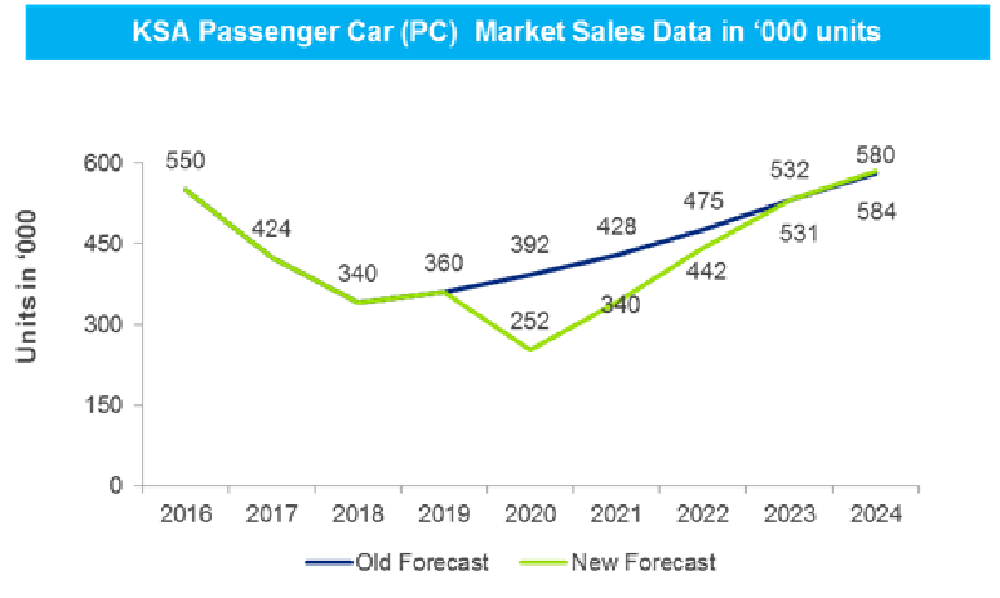

The GCC car market experienced a dip of 70 to 80% drop in footfalls during the peak of the pandemic; however, there are signs of recovery happening from Q3 2020 and the market is expected to reach its pre-covid growth trajectory by last quarter of 2021.

Source: Glasgow Consulting Group

Source: Glasgow Consulting Group

Globally, the logistics cost of cargo movement in the GCC is less given the subsidised fuel costs and low wages of drivers – and since there is no other mode of land transportation like rail, the truck market in the GCC is the backbone of transportation of goods within the GCC countries.

During the pandemic situation, one of the hardest hit sectors of the economy is the sale of commercial vehicles segment, however, the recovery is expected to start soon with light trucks sales catching up faster than the medium and heavy truck segment due to their usage in a diverse range of sectors vis-a-vis heavy trucks. The growth in ecommerce, retail sales and last mile connectivity, for instance, are major factors which would drive this growth. The heavy duty truck market is expected to bounce back with the opening of infra projects and tourism sector.

One of the positive impacts of the COVID crisis has been the evolving of new business models across sectors from automotive, healthcare to other consumer sectors, which has driven growth in online sales which indirectly benefits the auto sector and the recovery is expected to be fast based given the new demand drivers and the pent up demand.

However, a second wave of Covid cases is being seen in many countries now. If the outbreaks and reemergence of cases happens in GCC, consumer sentiment would remain muted even into Q1 2021, thereby the prolonging demand weakness.

The Glasgow Consulting Group Initiative’s GCG Automotive practice provides regional market intelligence, thought leadership and insights to the emerging & fast transforming sector in Middle East and Africa region. We help clients identify the top mega tends in areas of mobility solutions.