The automotive industry in the Middle East has been hit hard by the pandemic. Even before the pandemic, the KSA market for automobiles was not particularly stable. But the automotive industry is on its path to recovery. And as the industry is picking pace, there has been noticeable consumer trends in the passenger car aftermarket.

Consumer Trends: Pre- and Post-Covid

Saudi Arabia has been facing various socio-economic challenges in order to implement economic diversification policies. The financial trouble faced due to the rise of oil prices caused a decline in the passenger car market even before the worldwide pandemic. The growth in the automotive market between 2010 and 2015 was disrupted as oil revenue declined.

As the market was gradually accelerating, it suffered a slump in 2019 owing to Covid-19. It was expected that 2019 will be the year of recovery after a period of economic slowdown, but a nationwide lockdown was declared bringing everything to a standstill due to the pandemic. As sales of new cars dropped by 50%, the pandemic revived the prospects of used cars.

In spite of the disruptive headwinds like the pandemic and Russia-Ukraine conflict, through the Saudi Vision 2030, the Government aims to boost economic growth during 2020-2029. Some of the long-standing problems in the nation are already being addressed by the reforms.

As the efforts to boost the economy and social reforms continue, auto sales are bound to accelerate. In KSA, among the reforms introduced so far, the automotive business is getting positively impacted due to the following reforms:

- Moderate economic growth: Post Covid, economies are returning to semblance of normalcy, and the picture in the automotive sector is improving.

- Saudi Arabia’s new rules allowing women to drive: This is most certainly a welcome change that can drive the country’s automotive growth.

- Government’s push toward developing ten smart cities under the National Transformation Program (NTPs): Advancements in technology and innovations mean increased business opportunities, resulting in increased citizens’ employment, better infrastructure, and high incomes.

The passenger car sales market is expected to grow at 10.6% CAGR (2019–2024) and reach sales of about 600,000 by 2024. Allowing women the right to drive means there will be a rise in car sales. As of 2019, 92% of households had at least one car and around 56% had more than one car. This clearly indicates that as the women are getting behind the steering, they are most likely to drive their family car.

The Saudi passenger car market is segmented based on vehicle type, fuel type, and transmission type. The market can be classified by hatchbacks, sedans, pickup trucks, multi-purpose vehicles (MPVs), and sports utility vehicles (SUV) based on vehicle type. The market share of sedans is at 28.9%, second to SUVs which account for 50.7%.

Japanese brands, popular for the easy availability of spare parts at cheap rates and low maintenance are regarded as more dependable than their European and American counterparts. Brands like Toyota, Nissan, and Mitsubishi are the top players in the country’s passenger car market. Toyota, one of the world’s largest automobile manufacturers, has a market share of 30.9% in the KSA. Furthermore, Japanese brands have excellent resale value, and with the increased demand of used vehicles, more people are choosing Japanese brands. However, European and American automakers have a significant share in the luxury cars segment. Ford, Tesla, BMW, Porsche, and Jaguar are a few of the luxury car market hits.

Trends in passenger car aftermarket

As the trend toward owning private vehicles is increasing, the aftermarket service sector is set to witness proportionate growth. The disruption created by the Covid-19 crisis pushed manufacturers to consider strengthening the opportunity to scale the aftermarket services. They took advantage of the disruption and brought long-planned changes and innovations in the aftermarket that changed the nature of their relationship with the customer base and channels.

The key drivers in the KSA passenger car aftermarket are discussed below:

- The third-party services and authorized service centres adoption of customer satisfaction and willing to give them strong aftersales service

- Consumers’ rising interest in customizing vehicles, often by replacing car parts and adding accessories

- Saudi vehicle owners’ preference towards third-party service once the vehicle is out of warranty

- Surge in the number of female drivers on road

- Increasing digital platforms in the automotive space selling spare parts online and offering car servicing

Emerging trends

The KSA automotive market is pushing toward a ‘service oriented’ business model. OEMs and third-party manufacturers are focusing more on customer experience and after-sales service.

The aftermarket growth can be attributed to consumers’ demand for the modification of their vehicles, increasing distance travelled in a year and increasing awareness to adopt preventive maintenance service. Customers in KSA are eager to upgrade their automobiles’ performance mostly by enhancing and customizing the look of their vehicles. Over the past ten years, the demand for car modifications has grown tremendously in the KSA. This trend will continue in the future increasing demand for accessories. As Saudi drivers look to make performance modifications to their vehicles, this trend has increased the demand for spare parts.

Second hand auto spare parts market in the KSA has significantly developed over the last decade. KSA is one of the key suppliers of second hand automotive spare parts in the Middle East owing to the largest automotive fleet in the region. The majority of second hand auto spare parts are collected from damaged cars, which are sold by insurance firms at throwaway prices, and the remaining come from police auctions.

The growth of aftermarkets cannot be credited to only used and second hand vehicles. Brand new cars in the KSA have a warranty of 2–6 years. After the warranty expires, most Saudis opt for car servicing through local workshops owing to its low cost and convenience.

In Saudi Arabia, 83% of vehicles are out of warranty. As a result, 94% of these vehicle owners consider third-party aftermarket services. This implies maximum clients are willing to travel to an outside independent multi-brand workshop for vehicle servicing. Most third-party auto service companies in the country offer highly automated services comparable with authorized service centres.

Most of these customers do not have any fixed servicing requirements. The prominent services include oil change, oil filter change, car washing, wheel balancing, tire change, and filter check. Surprisingly, Saudi customers prefer to get car washing, filter check, and tire change within city workshops. However, battery services and brake pads are the popular services done in the outside city workshops. Customers also seek specialized services like oil change, AC services, and other services while traveling to the outside city workshops. The reasons cited by customers for such decisions are quality of services and work, cheaper cost of servicing and less time for servicing are major reasons to use outside workshops.

To communicate and connect with clients, authorised service centres, third-party services, and online service providers are adopting a multichannel strategy. The companies are utilising technology like social media platforms, artificial intelligence (AI), and data analytics to provide clients with the correct product or service at the right time.

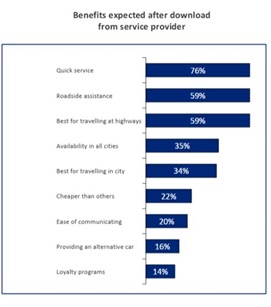

More than 90% respondents are willing to consider using an app for roadside assistance

Covid-19 has changed businesses’ perceptions about utilizing the online market space. One of the key factors propelling the expansion of the UAE automotive aftermarket includes the emergence of online portals providing aftermarket components and businesses switching to digital platforms for a smoother experience for the clients. Social media’s expanding impact on customer decision-making processes and increased customer knowledge of automotive components are supporting market expansion.

Online players in the automotive market are leveraging social media and over-the-top media services such as YouTube and WhatsApp to connect with customers for marketing/promotions and claims settlement. They are working on improving their apps by regularly fixing issues on both iOS and Android versions. Almost 92% of Saudi customers have shown a very high willingness of using an app for roadside assistance (92%) due to quick service and support on highways and within the city.

The benefits expected by consumers after downloading app for roadside assistance

Ezhalha is the first digital platform in the Middle East that connects the service provider to the customer via mobile app. This gives customers ease of access and convenience to choose any service whenever required. Another app, Carcility is UAE’s first dedicated car maintenance and servicing app. It provides you with a one-stop solution for all your car requirements. Users of the app have also boasted about the use of premium services at an affordable cost.

These apps provide services like car service booking, premium car services & repair and insurance claims. What is really working in the customer’s favour is the availability of pick-up and drop-off of the vehicles. This saves the consumer the trouble of visiting the service centre.

KSA is expected to witness significant growth in the passenger car aftermarket in the coming years. Saudi customers looking to improve their vehicles’ performance will drive up the demand for spare parts. Also, increased passenger car in the market will keep generating the need for spare parts and automotive components.

With revenue worth >SAR 26.6 billion from tires, batteries, lubricants, and engine components and accessories in 2017, KSA was already the leading auto aftermarket in the Middle East. With the removal of the ban on women driving, the automotive industry focusing on customer service, and utilization of the online space as a major sales channel, this figure is most likely to increase in the coming years.